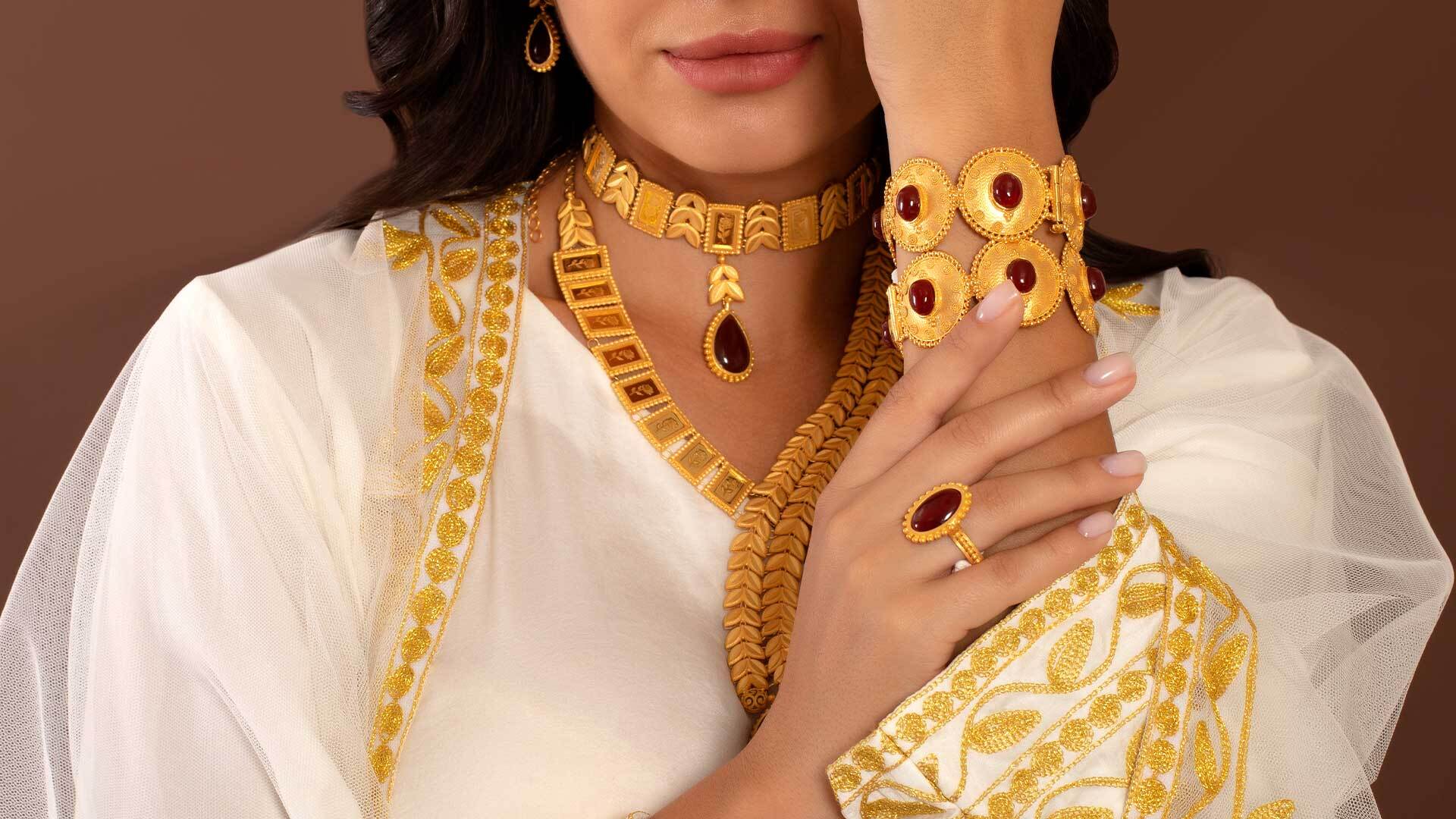

Gold Jewellery Dubai: An Insider's Consider the most up to date Patterns

Gold Jewellery Dubai: An Insider's Consider the most up to date Patterns

Blog Article

Understand the Advantages of Investing in Gold Jewelry as a Financial Asset

Gold jewelry has long been viewed as even more than plain adornment; it stands as a robust monetary property with complex benefits. Integrating gold jewellery into a diversified profile can minimize threats associated with market fluctuations. Beyond its monetary benefits, the social and sentimental importance of gold jewellery adds layers of value.

Historical Worth Retention

Exactly how has gold handled to preserve its allure and value throughout centuries? The long-lasting appeal of gold can be attributed to its intrinsic qualities and historical significance.

Historically, gold has played an essential role in financial systems as a legal tender and a requirement for currencies. This long-standing organization with financial systems underpins its perceived security and integrity as a shop of value. Unlike various other products, gold does not rust or taint, which guarantees its long life and continual need.

Culturally, gold jewellery has stood for both personal adornment and a tangible property that can be given with generations, preserving wide range and custom. Its value retention is further strengthened by its universal recognition and approval, transcending social and geographic boundaries. These qualities collectively add to gold's capability to maintain its attraction and value as a useful economic possession gradually.

Hedge Against Rising Cost Of Living

Gold jewellery functions as a reliable inflation-hedge, using protection against the abrasive results of increasing rates. As inflation erodes the buying power of currency, substantial properties like gold maintain their intrinsic value, making them a reliable store of riches. Historically, gold has actually demonstrated strength during durations of economic instability, as its rate frequently climbs in response to inflationary pressures. This particular makes gold jewelry not only a symbol of high-end yet also a tactical monetary property for preserving riches gradually.

Unlike fiat money, which can be subject to adjustment and decline by governments, gold's value is inherently secure. Investors looking for to expand their profiles usually transform to gold jewellery to offset the risks linked with money decline and economic turmoil.

Easy Liquidity Alternatives

Among the considerable advantages of purchasing gold jewelry is its simple liquidity. Unlike numerous various other types of investment, gold jewelry can be swiftly converted into cash money. This characteristic renders it an excellent alternative for individuals seeking an economic possession that can be easily accessed during times of urgent demand. The international market for gold ensures that there is constantly a need, which promotes smooth deals. Gold jewellery can be sold or pawned at local jewellery shops, pawnshops, or through on the internet platforms, providing multiple methods for liquidation.

The procedure of selling off gold jewellery is somewhat straightforward. Jewellery items are generally assessed based upon their weight and purity, with the present market price for gold determining their money worth. This clear and standardized approach of valuation aids in accomplishing reasonable prices, reducing the danger of economic losses throughout liquidation. Additionally, the popularity of gold jewelry in social and financial contexts worldwide enhances its resale value, making sure that it continues to be a durable financial asset.

Profile Diversification

Incorporating gold jewelry into a financial investment portfolio can use significant diversity advantages. This valuable steel frequently acts differently from other property classes, such as bonds and supplies, which are susceptible to market volatility and economic changes. Gold's unique buildings allow it to function as a bush against inflation and money changes, consequently providing security when conventional properties falter. By integrating gold jewellery, capitalists can reduce threats and potentially enhance the total efficiency of their portfolios.

Gold jewellery is not just a substantial her comment is here possession however also retains inherent worth, independent of economic market problems. Unlike paper possessions, which can become pointless in severe situations, gold has a historical online reputation for maintaining riches.

Additionally, gold jewellery's international charm and demand ensure liquidity, making it possible for capitalists to promptly transform their holdings into cash money if required. This liquidity can be important for rebalancing portfolios or confiscating new financial investment possibilities. Eventually, incorporating gold jewelry provides a strategic benefit, improving portfolio durability why not try these out and fostering lasting monetary security.

Sentimental and social Value

The cultural and nostalgic value of gold jewelry is a considerable variable that sets it apart from various other forms of financial investment. Unlike bonds or supplies, gold jewellery commonly transcends simple economic worth, personifying deep-rooted social traditions and individual memories. gold jewellery dubai. In numerous societies, gold is an icon of riches, success, and condition, frequently talented throughout significant life occasions such as wedding celebrations, milestones, and anniversaries. This social value not only improves its desirability however also adds to its sustaining market need.

Moreover, gold jewelry usually lugs emotional value, passed down via generations as valued antiques. These pieces can evoke familial and personal backgrounds, acting as concrete connections to the past. The psychological accessory associated with gold jewelry can make it a valued possession, valued not merely for its monetary well worth however, for its ability to convey and maintain household narratives and practices.

Verdict

Investing in gold jewelry uses considerable advantages as an economic possession. Diversification through gold jewelry minimizes exposure to typical market threats.

Past its monetary benefits, the cultural and nostalgic importance of gold jewelry adds layers of worth (gold jewellery dubai). Gold jewellery can be offered or check it out pawned at local jewellery shops, pawnshops, or with on-line systems, providing several methods for liquidation

The popularity of gold jewelry in financial and cultural contexts worldwide improves its resale worth, making sure that it remains a robust economic asset.

Gold jewelry is not just a tangible possession but additionally preserves intrinsic worth, independent of financial market conditions. The psychological attachment connected with gold jewelry can make it a valued possession, valued not just for its financial worth yet for its capacity to maintain and convey family members stories and practices.

Report this page